The O’ahu luxury real estate market in 2024 showed an overall increase in activity. This was particularly true in the single-family home market. Sales in homes priced above $2 million were up across most price ranges compared to 2023. The number of homes sold increased from 273 in 2023 to 307 in 2024, reflecting a broader demand.

However, the $6 million to $9.99 million price range saw a decline in sales, dropping from 27 in 2023 to just 16 in 2024. This suggests that while demand was up in general, ultra-high-end properties in that particular price bracket experienced a slowdown.

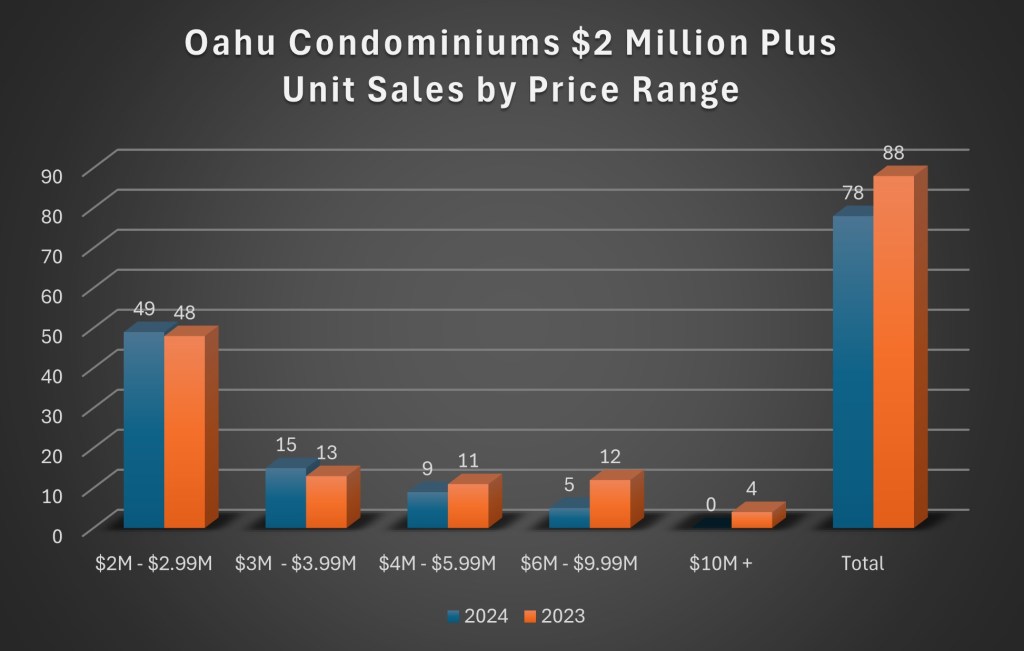

For the condo market, resales in the $2 million to $5.99 million range remained relatively stable compared to the previous year. However, the ultra-luxury condo segment over $6 million saw a significant decrease. There were only 5 sales in 2024. In 2023, there were 16 sales.

Overall, the luxury home market remained strong. The decline in ultra-luxury condo sales and the drop in mid-high-end homes suggest a more selective buyer pool in certain segments. This could be due to shifting economic conditions, market saturation, or changing buyer preferences.